Hello experts,

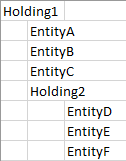

Let's say I have the following consolidation perimeter in HFM:

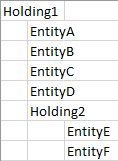

Now EntityD is going to move up under Holding1 sometime during the year so that we will then have this:

The requirement that we didn't have before is that we now have to prepare finacial statements for both Holdings (only for Holding1 before), meaning that EntityD will have part of its net income consolidated into Holding2. It also means that we will have an exit from the consolidation perimeter for Holding2 while no changes will be needed for Holding1 since EntityD is still under its perimeter.

I have the following options in mind, but I'm open to other suggestions

-

keep EntityD under both Holdings, and then create two other entities (EntityD1 under Holding1 and EntityD2 under Holding2) where I would post journal entries in <EC> to control where the net income and the balance sheet are going.

-

create a consolidation tree exclusively for the consolidation of Holding2, but I would still need an entity to post journals to adjust the amounts found in EntityD under Holding2.

-

keep EntityD under both Holdings, and then post journal entries in [CA] to control where the net income and the balance sheet are going. Note that we don't really want to use [CA], so this option isn't really an option.

-

have a separate application for the consolidation of Holding2.

If anybody has experience with something like this, I would gladly take some advice!

Thanks!