Hello,

I have the next XML into a BLOB field:

<?xml version="1.0" encoding="UTF-8"?>

<Invoice xmlns="urn:oasis:names:specification:ubl:schema:xsd:Invoice-2" xmlns:cac="urn:oasis:names:specification:ubl:schema:xsd:CommonAggregateComponents-2" xmlns:cbc="urn:oasis:names:specification:ubl:schema:xsd:CommonBasicComponents-2" xmlns:ccts="urn:un:unece:uncefact:documentation:2" xmlns:ds="http://www.w3.org/2000/09/xmldsig#" xmlns:ext="urn:oasis:names:specification:ubl:schema:xsd:CommonExtensionComponents-2" xmlns:qdt="urn:oasis:names:specification:ubl:schema:xsd:QualifiedDatatypes-2" xmlns:rsc="urn:rsc:names:specification:ubl:peru:schema:xsd:RscAggregateComponents-1" xmlns:udt="urn:un:unece:uncefact:data:specification:UnqualifiedDataTypesSchemaModule:2" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance">

<cbc:UBLVersionID>2.1</cbc:UBLVersionID>

<cbc:CustomizationID schemeAgencyName="PE:SUNAT">2.0</cbc:CustomizationID>

<cbc:ID>F001-0077889</cbc:ID>

<cbc:IssueDate>2021-01-13</cbc:IssueDate>

<cbc:IssueTime>14:34:20</cbc:IssueTime>

<cbc:DueDate>2021-01-31</cbc:DueDate>

<cbc:InvoiceTypeCode name="Tipo de Operacion" listSchemeURI="urn:pe:gob:sunat:cpe:see:gem:catalogos:catalogo51" listID="0101">01</cbc:InvoiceTypeCode>

<cbc:Note languageLocaleID="1000"><![CDATA[CUATRO MIL SETECIENTOS SETENTA Y NUEVE CON 00/100 SOLES]]></cbc:Note>

<cbc:DocumentCurrencyCode listID="ISO 4217 Alpha" listName="Currency" listAgencyName="United Nations Economic Commission for Europe">PEN</cbc:DocumentCurrencyCode>

<cac:Signature>

<cbc:ID>IDSign20557425889</cbc:ID>

<cac:SignatoryParty>

<cac:PartyIdentification>

<cbc:ID schemeName="Documento de Identidad" schemeAgencyName="PE:SUNAT" schemeURI="urn:pe:gob:sunat:cpe:see:gem:catalogos:catalogo06">20557425889</cbc:ID>

</cac:PartyIdentification>

<cac:PartyName>

<cbc:Name><![CDATA[FIBERLUX SAC]]></cbc:Name>

</cac:PartyName>

</cac:SignatoryParty>

<cac:DigitalSignatureAttachment>

<cac:ExternalReference>

<cbc:URI>#signature20557425889</cbc:URI>

</cac:ExternalReference>

</cac:DigitalSignatureAttachment>

</cac:Signature>

<cac:TaxTotal>

<cbc:TaxAmount currencyID="PEN">729.00</cbc:TaxAmount>

<cac:TaxSubtotal>

<cbc:TaxableAmount currencyID="PEN">4050.00</cbc:TaxableAmount>

<cbc:TaxAmount currencyID="PEN">729.00</cbc:TaxAmount>

<cac:TaxCategory>

<cbc:ID schemeID="UN/ECE 5305" schemeName="Tax Category Identifier" schemeAgencyName="United Nations Economic Commission for Europe">S</cbc:ID>

<cac:TaxScheme>

<cbc:ID schemeName="Codigo de tributos" schemeAgencyName="PE:SUNAT" schemeURI="urn:pe:gob:sunat:cpe:see:gem:catalogos:catalogo05">1000</cbc:ID>

<cbc:Name>IGV</cbc:Name>

<cbc:TaxTypeCode>VAT</cbc:TaxTypeCode>

</cac:TaxScheme>

</cac:TaxCategory>

</cac:TaxSubtotal>

</cac:TaxTotal>

<cac:LegalMonetaryTotal>

<cbc:LineExtensionAmount currencyID="PEN">4050.00</cbc:LineExtensionAmount>

<cbc:TaxInclusiveAmount currencyID="PEN">4779.00</cbc:TaxInclusiveAmount>

<cbc:AllowanceTotalAmount currencyID="PEN">0.00</cbc:AllowanceTotalAmount>

<cbc:ChargeTotalAmount currencyID="PEN">0.00</cbc:ChargeTotalAmount>

<cbc:PayableAmount currencyID="PEN">4779.00</cbc:PayableAmount>

</cac:LegalMonetaryTotal>

<cac:InvoiceLine>

<cbc:ID>1</cbc:ID>

<cbc:InvoicedQuantity unitCode="ZZ" unitCodeListID="UN/ECE rec 20" unitCodeListAgencyName="United Nations Economic Commission for Europe">1.000</cbc:InvoicedQuantity>

<cbc:LineExtensionAmount currencyID="PEN">850.00</cbc:LineExtensionAmount>

<cac:PricingReference>

<cac:AlternativeConditionPrice>

<cbc:PriceAmount currencyID="PEN">1003.000000000</cbc:PriceAmount>

<cbc:PriceTypeCode listName="Tipo de Precio" listAgencyName="PE:SUNAT" listURI="urn:pe:gob:sunat:cpe:see:gem:catalogos:catalogo16">01</cbc:PriceTypeCode>

</cac:AlternativeConditionPrice>

</cac:PricingReference>

<cac:TaxTotal>

<cbc:TaxAmount currencyID="PEN">153.00</cbc:TaxAmount>

<cac:TaxSubtotal>

<cbc:TaxableAmount currencyID="PEN">850.00</cbc:TaxableAmount>

<cbc:TaxAmount currencyID="PEN">153.00</cbc:TaxAmount>

<cac:TaxCategory>

<cbc:ID schemeID="UN/ECE 5305" schemeName="Tax Category Identifier" schemeAgencyName="United Nations Economic Commission for Europe">S</cbc:ID>

<cbc:Percent>18.00</cbc:Percent>

<cbc:TaxExemptionReasonCode listAgencyName="PE:SUNAT" listName="Afectacion del IGV" listURI="urn:pe:gob:sunat:cpe:see:gem:catalogos:catalogo07">10</cbc:TaxExemptionReasonCode>

<cac:TaxScheme>

<cbc:ID schemeName="Codigo de tributos" schemeAgencyName="PE:SUNAT" schemeURI="urn:pe:gob:sunat:cpe:see:gem:catalogos:catalogo05">1000</cbc:ID>

<cbc:Name>IGV</cbc:Name>

<cbc:TaxTypeCode>VAT</cbc:TaxTypeCode>

</cac:TaxScheme>

</cac:TaxCategory>

</cac:TaxSubtotal>

</cac:TaxTotal>

<cac:Item>

<cbc:Description><![CDATA[PRESTACION DE SERVICIOS - INTERNET]]></cbc:Description>

<cac:SellersItemIdentification>

<cbc:ID><![CDATA[S02]]></cbc:ID>

</cac:SellersItemIdentification>

</cac:Item>

<cac:Price>

<cbc:PriceAmount currencyID="PEN">850.000000000</cbc:PriceAmount>

</cac:Price>

</cac:InvoiceLine>

<cac:InvoiceLine>

<cbc:ID>2</cbc:ID>

<cbc:InvoicedQuantity unitCode="ZZ" unitCodeListID="UN/ECE rec 20" unitCodeListAgencyName="United Nations Economic Commission for Europe">1.000</cbc:InvoicedQuantity>

<cbc:LineExtensionAmount currencyID="PEN">2600.00</cbc:LineExtensionAmount>

<cac:PricingReference>

<cac:AlternativeConditionPrice>

<cbc:PriceAmount currencyID="PEN">3068.000000000</cbc:PriceAmount>

<cbc:PriceTypeCode listName="Tipo de Precio" listAgencyName="PE:SUNAT" listURI="urn:pe:gob:sunat:cpe:see:gem:catalogos:catalogo16">01</cbc:PriceTypeCode>

</cac:AlternativeConditionPrice>

</cac:PricingReference>

<cac:TaxTotal>

<cbc:TaxAmount currencyID="PEN">468.00</cbc:TaxAmount>

<cac:TaxSubtotal>

<cbc:TaxableAmount currencyID="PEN">2600.00</cbc:TaxableAmount>

<cbc:TaxAmount currencyID="PEN">468.00</cbc:TaxAmount>

<cac:TaxCategory>

<cbc:ID schemeID="UN/ECE 5305" schemeName="Tax Category Identifier" schemeAgencyName="United Nations Economic Commission for Europe">S</cbc:ID>

<cbc:Percent>18.00</cbc:Percent>

<cbc:TaxExemptionReasonCode listAgencyName="PE:SUNAT" listName="Afectacion del IGV" listURI="urn:pe:gob:sunat:cpe:see:gem:catalogos:catalogo07">10</cbc:TaxExemptionReasonCode>

<cac:TaxScheme>

<cbc:ID schemeName="Codigo de tributos" schemeAgencyName="PE:SUNAT" schemeURI="urn:pe:gob:sunat:cpe:see:gem:catalogos:catalogo05">1000</cbc:ID>

<cbc:Name>IGV</cbc:Name>

<cbc:TaxTypeCode>VAT</cbc:TaxTypeCode>

</cac:TaxScheme>

</cac:TaxCategory>

</cac:TaxSubtotal>

</cac:TaxTotal>

<cac:Item>

<cbc:Description><![CDATA[PRESTACION DE SERVICIOS - TRANSMISION DE DATOS]]></cbc:Description>

<cac:SellersItemIdentification>

<cbc:ID><![CDATA[S03]]></cbc:ID>

</cac:SellersItemIdentification>

</cac:Item>

<cac:Price>

<cbc:PriceAmount currencyID="PEN">2600.000000000</cbc:PriceAmount>

</cac:Price>

</cac:InvoiceLine>

<cac:InvoiceLine>

<cbc:ID>3</cbc:ID>

<cbc:InvoicedQuantity unitCode="ZZ" unitCodeListID="UN/ECE rec 20" unitCodeListAgencyName="United Nations Economic Commission for Europe">1.000</cbc:InvoicedQuantity>

<cbc:LineExtensionAmount currencyID="PEN">600.00</cbc:LineExtensionAmount>

<cac:PricingReference>

<cac:AlternativeConditionPrice>

<cbc:PriceAmount currencyID="PEN">708.000000000</cbc:PriceAmount>

<cbc:PriceTypeCode listName="Tipo de Precio" listAgencyName="PE:SUNAT" listURI="urn:pe:gob:sunat:cpe:see:gem:catalogos:catalogo16">01</cbc:PriceTypeCode>

</cac:AlternativeConditionPrice>

</cac:PricingReference>

<cac:TaxTotal>

<cbc:TaxAmount currencyID="PEN">108.00</cbc:TaxAmount>

<cac:TaxSubtotal>

<cbc:TaxableAmount currencyID="PEN">600.00</cbc:TaxableAmount>

<cbc:TaxAmount currencyID="PEN">108.00</cbc:TaxAmount>

<cac:TaxCategory>

<cbc:ID schemeID="UN/ECE 5305" schemeName="Tax Category Identifier" schemeAgencyName="United Nations Economic Commission for Europe">S</cbc:ID>

<cbc:Percent>18.00</cbc:Percent>

<cbc:TaxExemptionReasonCode listAgencyName="PE:SUNAT" listName="Afectacion del IGV" listURI="urn:pe:gob:sunat:cpe:see:gem:catalogos:catalogo07">10</cbc:TaxExemptionReasonCode>

<cac:TaxScheme>

<cbc:ID schemeName="Codigo de tributos" schemeAgencyName="PE:SUNAT" schemeURI="urn:pe:gob:sunat:cpe:see:gem:catalogos:catalogo05">1000</cbc:ID>

<cbc:Name>IGV</cbc:Name>

<cbc:TaxTypeCode>VAT</cbc:TaxTypeCode>

</cac:TaxScheme>

</cac:TaxCategory>

</cac:TaxSubtotal>

</cac:TaxTotal>

<cac:Item>

<cbc:Description><![CDATA[PRESTACION DE SERVICIOS - SEGURIDAD GESTIONADA]]></cbc:Description>

<cac:SellersItemIdentification>

<cbc:ID><![CDATA[S04]]></cbc:ID>

</cac:SellersItemIdentification>

</cac:Item>

<cac:Price>

<cbc:PriceAmount currencyID="PEN">600.000000000</cbc:PriceAmount>

</cac:Price>

</cac:InvoiceLine>

</Invoice>

I need to read all the values inside cac: InvoiceLine.

In this case they are 3.

I only managed to show the 3 rows but not the values inside.

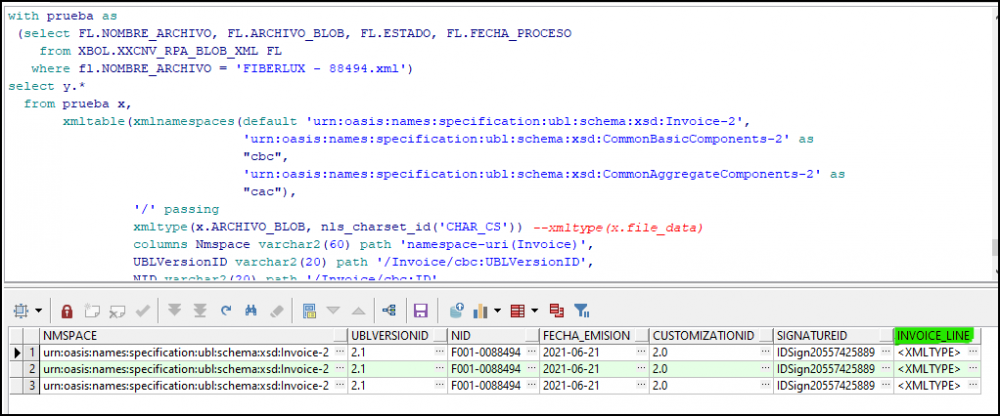

My Query is:

with prueba as

(select FL.NOMBRE_ARCHIVO, FL.ARCHIVO_BLOB, FL.ESTADO, FL.FECHA_PROCESO

from XBOL.XXCNV_RPA_BLOB_XML FL

where fl.NOMBRE_ARCHIVO = 'FIBERLUX - 88494.xml')

select y.*

from prueba x,

xmltable(xmlnamespaces(default 'urn:oasis:names:specification:ubl:schema:xsd:Invoice-2',

'urn:oasis:names:specification:ubl:schema:xsd:CommonBasicComponents-2' as

"cbc",

'urn:oasis:names:specification:ubl:schema:xsd:CommonAggregateComponents-2' as

"cac"),

'/' passing

xmltype(x.ARCHIVO_BLOB, nls_charset_id('CHAR_CS')) --xmltype(x.file_data)

columns Nmspace varchar2(60) path 'namespace-uri(Invoice)',

UBLVersionID varchar2(20) path '/Invoice/cbc:UBLVersionID',

NID varchar2(20) path '/Invoice/cbc:ID',

fecha_emision varchar2(20) path '/Invoice/cbc:IssueDate',

CustomizationID varchar2(20) path

'/Invoice/cbc:CustomizationID',

SignatureID varchar2(50) path

'/Invoice/cac:Signature/cbc:ID',

invoice_line XMLTYPE PATH '/Invoice/cac:InvoiceLine') y,

XMLTABLE(xmlnamespaces('urn:oasis:names:specification:ubl:schema:xsd:CommonAggregateComponents-2' as "cac",

'urn:oasis:names:specification:ubl:schema:xsd:CommonBasicComponents-2' as "cbc")

, '/cac:InvoiceLine' passing y.invoice_line

COLUMNS

linea varchar2(20) path 'cac:cbc:ID',

Cantidad varchar2(20) path 'cac:cbc:InvoicedQuantity');

I get this result:

Please, help me!